OLYMPIA, Wash. – Insurance Commissioner Mike Kreidler has adopted his rule temporarily banning insurers from using credit information to set auto, homeowner and renter insurance, effective March 4. In addition, he’s proposing a new transparency rule requiring insurers to provide policyholders with a written explanation for any premium change.

“I’m taking this action against insurers’ use of credit scoring in response to the economic harm many people have experienced during the COVID-19 pandemic—harm that has significantly impacted people who are already financially vulnerable,” said Kreidler. “We know that now, more than ever, credit reporting is unreliable. It is unfair to base how much someone pays for frequently mandatory insurance on an unreliable and fluctuating factor like a credit score.”

The federal government recognized that many people are suffering financially and passed the CARES Act that allows lenders to grant relief to some people who are struggling financially. However, the protections do not apply to everyone. And when the CARES Act ends, any delinquency could then be reported or show up as a blackout period on someone’s credit report. This makes the credit histories insurers are using unreliable and inaccurate. Since it is not clear when the public health emergency will end, the rule requires insurers to temporarily remove the inaccurate credit rating factor. The rule will be in effect starting March 4 through three years after the federal or state emergency declarations end, whichever is later.

Kreidler’s rule is designed to be rate neutral for the insurers, meaning any rate change is spread across all policyholders. Some will see a one-time rate increase and others will get a rate decrease, depending on how much their insurer relied on credit scoring. Based on consumer stories he heard during the rule’s public hearing, Kreidler asked insurers to provide additional information, including:

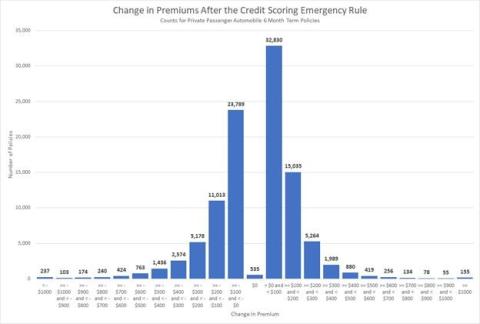

- An illustration called a histogram that shows the range of premium changes due to removing credit information as rating factor. Some insurers already provided these illustrations as part of their rate filings.

- Copies of any communications insurers used to describe the new credit rule to their policyholders.

He asked for copies of the communications because several investigations the OIC conducted on behalf of consumers uncovered that despite what they were told by their insurer, the premium change was not entirely due to the removal of credit scoring. In some responses they received, it was nearly impossible for the policyholder to determine what caused their premium to increase.

Only 12 companies representing 5.2% of the affected market provided the information Kreidler requested.

Based on the lack of transparency and responses, Kreidler is proposing a rule that requires insurers to provide policyholders with clear written explanations for any rate change. This proposed rule will include stakeholder involvement and a public hearing.

“If an insurer wants to change how much you pay for coverage, you deserve to know why,” said Kreidler. “And it shouldn’t be difficult to understand the reasons that led to the change. If your insurance company wants your business, you deserve an honest and clear answer. We’re going to help them give you one with this rule.”

Below is a histogram of the average premium change for the 12 companies that responded to Kreidler’s initial request for information on how removing credit as a rating factor impacted their policyholders:

“I understand that some people will be upset this rule is moving forward,” said Kreidler. “They believe they deserve a discount because of their good credit score, but I need to look at the fairness for all consumers in our state. And to base premium on a factor that is unreliable or inaccurate is not fair.

"While this rule is in effect, I intend to work with the Legislature, stakeholders and the insurance industry to see how we can permanently end the use of credit scoring in setting insurance premiums. It’s an outdated practice that relies on your creditworthiness instead of how you drive or treat your property. And if you believe you’re more deserving of a good rate because of your high credit scores, what do you say to the good drivers out there with low credit scores who pay an average of 80% more than you? We need to join the other states that have done so and end this discriminatory practice once and for all.”